Federal Treasurer, The Hon Dr Jim Chalmers MP, delivered the 2025-26 Federal Budget on Tuesday, 25 March 2025, headlining tax cuts and small business relief. Luckily for our members and sponsors, the Australian economy is projected to grow and strengthen over the near term. Here’s what you need to know.

Small businesses and medium enterprises have been at the forefront of economic setbacks in recent years. One major development from this year’s budget is the government’s plan to invest $12 million over four years from 2025 to 2026 to support and protect small businesses.

Gross Domestic Product (GDP) is projected to grow by 1.5% in 2024/25, strengthening to 2.25% in 2025-26. Economic growth corresponds with the security of consumers, leading to an increase in opportunities for small business growth and expanding their markets.

Cost-of-living pressures will ease as a result of the centrepiece tax cut, reducing the first marginal tax rate from 16% to 14% over two years from 1 July 2026, at a cost of $17.1bn over five years. As cost-of-living pressures ease, hopefully this will release discretionary spending in the small business economy.

There was one particular measure which will provide some direct support for small business operating costs: energy bill rebates. The government has chosen to extend the existing energy bill rebates that were due to expire on 30 June 2025 for an additional two quarters, resulting in two additional quarterly $75 energy bill rebates through to 31 December 2025. Although a small measure, it will provide an additional $150 to a small business, benefiting approximately 1 million small businesses in the economy.

The budget does contain targeted initiatives aimed at small business relief. Measures include:

- $56.7 million in Energy Efficiency Grants for small and medium-sized enterprises, with grants of up to $25,000 per business for appliance upgrades and efficient heating improvements.

- $2 billion over 19 years from 2024–25 for Green Aluminium Production Credits to provide production-based grants to support Australian aluminium smelters switching to renewable electricity before 2036, provided to eligible Australian Aluminium production facilities over a 10-year period

- $1 billion over seven years from 2024–25 for the Green Iron Investment Fund to fund green iron projects through capital grants to support producers to establish or transition into low emissions facilities in Australia.

- $2 billion to recapitalise the Clean Energy Finance Corporation to invest in renewable energy, energy efficiency and low emissions technologies.

- $45.2 million over three years from 2025–26 to support Agriculture, Fisheries and Forestry portfolio priorities including for trade and export and national food security strategy

The topic of climate and energy has never been more prevalent than today, and the budget has prioritised Australian citizens and businesses to create a better future. Continuing the government’s Future Made in Australia agenda, 3.2 billion dollars is planning to be invested in Australia’s metal industry. This includes:

- $2 billion over 19 years from 2024–25 for Green Aluminium Production Credits to transition to renewable energy.

- $1 billion over seven years from 2024–25 for the Green Iron Investment Fund, with up to $500 million to transform the Whyalla Steelworks.

What does this mean for you? The government’s energy and climate policies including its flagship Future Made in Australia agenda, has become a priority of utmost importance. To compound this, 1.8 billion dollars has been provided in more energy bill relief for households and small businesses, and 2 billion dollars has been provided for Green Aluminium Production Credits. Households and small businesses will receive energy bill relief of $150 through to the end of 2025. Now is the time to tap into green, cleaner energy solutions, and go sustainable.

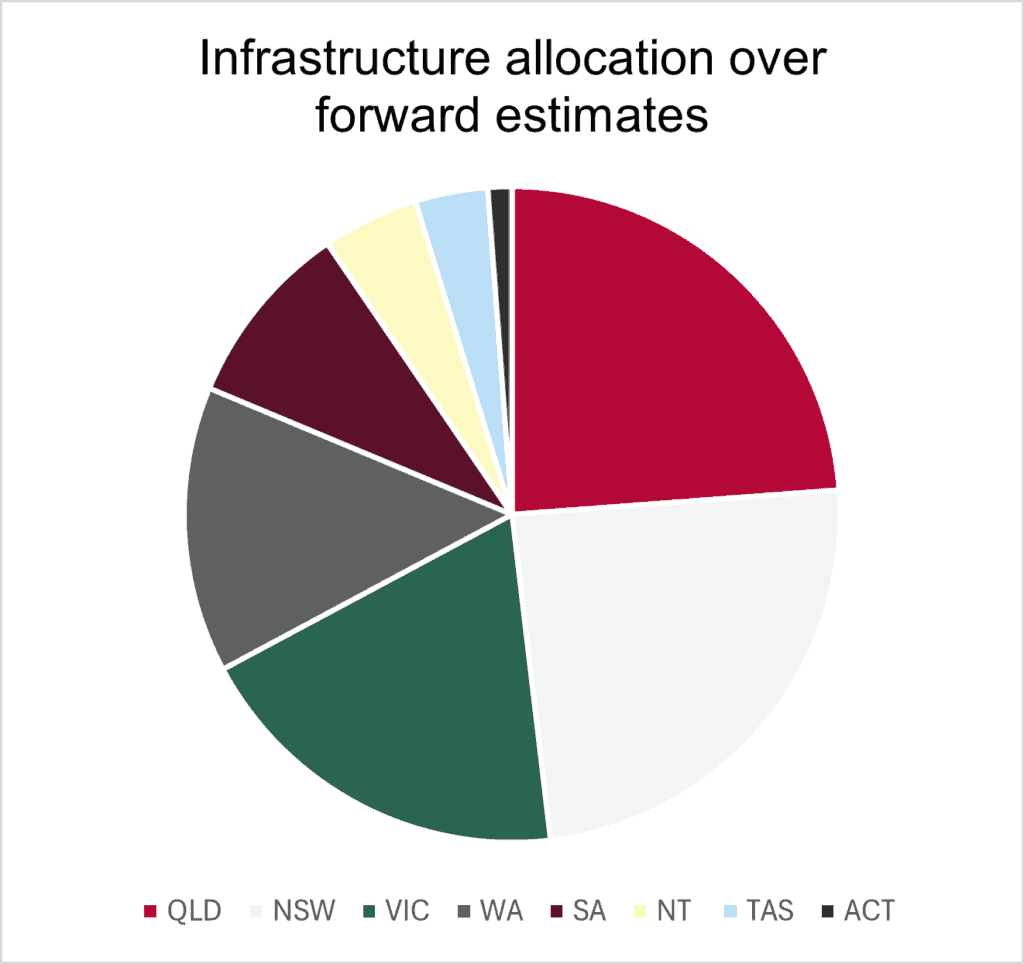

In terms of transport and infrastructure, the budget is providing a further $15.6 billion in new investments predominantly in road and rail projects across all states and territories. There are four new infrastructure commitments which will enhance the connectivity of Sydney’s roads:

- Terrigal Drive Upgrades ($115 million)

- South West Sydney Corridor ($1 billion)

- Townson, Burdekin and Garfield Road Upgrades ($580 million)

- Fifteenth Avenue Upgrade ($500 million)

Below is a table illustrating the ‘winners’ and ‘losers’ from this year’s budget. Overall, the future is looking bright for our Sponsors and Members. We wish everyone good luck for the new financial year!

| Winners and Losers from the 2025 Budget | |||

| Winner | No change | Loser | |

| Taxpayers | ✅ | ||

| Electricity bills | ✅ | ||

| Foreign home buyers | ✅ | ||

| Budget balance | ✅ | ||

| Economic outlook | ✅ | ||

| Job switchers | ✅ | ||

| Tax revenue | ✅ | ||

| Women’s health | ✅ | ||

| Student debt holders | ✅ | ||

| Social cohesion | ✅ | ||

| Temporary migrants | ✅ | ||

| Tradies | ✅ | ||

| Australian products | ✅ | ||

| Aged care workers | ✅ | ||

| Childcare | ✅ | ||

| Major roads | ✅ | ||

| First home buyers | ✅ | ||

| Health | ✅ | ||

| National Disability Insurance Agency | ✅ | ||

| Consultants | ✅ | ||